With 2024 almost in the rear-view mirror, it’s certainly been one for the history books. The UK elected the first Labour government in 14 years with a landslide victory, marking a major change to the economy and renewing commitments to grow the UK property market over the next 5 years.

Despite the change in government, the housing market did make a return to growth, supported in part by lower mortgage rates, increasing by 1.5% which is a significant improvement on last year.

Just five months into Labour’s first term, they’ve revealed what commentators are referring to as a refresh, with the government outlining six key areas to focus on in the coming months. Housing remains a priority for the government with ambitious targets to build 1.5 million homes by the end of the parliament.

What Happened With House Prices In 2024?

The year started with optimism about house price growth in spite of turbulent times for the UK’s economy. The prospect of an election helped the market remain consistent.

- As with the previous year, 2024 was a buyers’ market, meaning sellers need to be competitive on price to generate interest and facilitate a quick sale.

- Though there’s still a chronic shortage of housing, the market is more populated in 2024 than in previous years, providing buyers more choice.

- Manchester property prices increased on average by 14%, while Liverpool saw 19% increases city-wide.

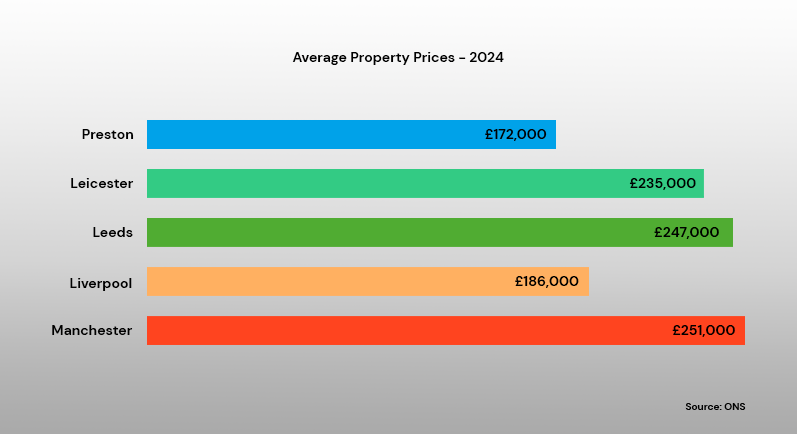

UK Average House prices

- Manchester – £251,000

- Liverpool – £186,000

- Leeds – £247,000

- Birmingham – £236,000

- Leicester – £235,000

- Preston – £172,000

- Brighton – £427,000

UK House Price Predictions For 2025?

Experts predict that 2025 will once again be a buyers’ market as choice remains the focus. With Labour’s ambitious plans to build 1.5 million homes by the next parliament serving as one of their key pledges, this style of market should remain. Although it’s worth noting that those house building targets are millions short of what would be required to firmly bridge the gap between housing supply and demand.

- Buyers market – More choice, longer average sale time

- Average prices predicted to increase

- Mortgage rates set to fall – creating a boost to buyer confidence

With prices predicted to rise, the start of a new year presents the best time to invest in property in the UK. If reflections from the past year are considered, price growth means buying in Q4 2024 will be more expensive than buying in Q1 2024. So buying in Q1 2025 is going to offer a greater return on investment over time, than buying in the latter half of the year.

How has Rental Growth Impacted The UK Property Market?

Despite economic growth rising only marginally across the UK, rents continued their upward trend that has been seen year on year over the past decade.

Commuter towns saw the largest differences in 2024 with experts noting a new trend of rents rising faster on the outskirts of major cities, opening up property investment potential in suburbs, towns and key transformation regions.

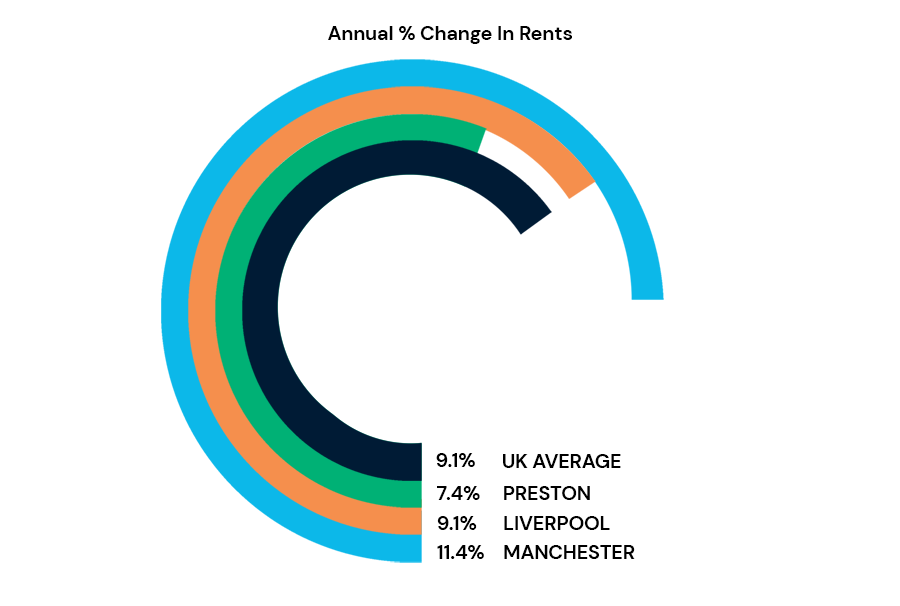

The Office for National Statistics reported that the average UK rents increased by 9.1% from November 2023 to November 2024.

Annual % Change In Rents

- Manchester – 11.4%

- Liverpool – 9.1%

- Leeds – 3.7%

- Birmingham – 8.7%

- Leicester – 12.0%

- Preston – 7.4%

- Brighton – 5.1%

Here are some measures of growth across the regions in 2024

Regionally the North West continues to outperform other UK regions, experiencing a 5.9% Increase overall, while London pales in comparison with only a slight increase of 1.3%. Yorkshire and Humber levelled with the South East achieving increases of over 4%.

UK Monthly Rent Average

- Manchester – £1,266

- Liverpool – £801

- Leeds – £1,100

- Birmingham – £1,025

- Leicester – £947

- Preston – £691

- Brighton – £1757

Rental Growth Predictions For 2025

Savills predict a series of changes to the rental landscape over the next 12 months which suggests many traditional landlords may be looking to sell. While this is good for supply, it’s doesn’t present a great option for landlords or investors looking to buy. Many of these properties may be older with long-term issues. Buying new or off plan properties is the way to go for landlords and investors in 2025 as it’s going to keep maintenance costs down and remove underlying property issues.

Cities such as Manchester, Liverpool and commuter towns such as Preston are going to offer these options where both house price growth and rental yields remain high.

What have property investors been doing in 2024?

This year has focused heavily on portfolio diversification, with property investors exploring alternative investments that offer higher returns. During the Spring and Summer months, hotel room investments emerged as the most popular option, highlighted by the rapid sell-out of our flagship South Coast hotel investment within weeks.

Traditional buy-to-let properties remain the top-selling category overall, with apartments performing only slightly slower than in 2023. According to Zoopla, properties in Liverpool sold within 19 days (+2 days compared to 2023), while those in Manchester sold within 23 days (+2 days).

Where To Invest In Property In 2025

We’ve already covered this extensively in our article ‘9 Best Areas With High Rental Yields In The UK’. However, in summary, we focused on areas with substantial rental growth and consistent yields.

- Manchester

- Liverpool

- Leeds

- York

- Preston

- Hull

- Warrington

- Stoke-On-Trent

- Luton

How to invest in UK property in 2025

Get in touch with us for more information or to make an enquiry

Written by: Perry Jax

Experienced Marketing professional working in the real estate investments sector.